what is tax assessment in real estate

57 minutes agoHistorically non-UK domiciled individuals would often choose to hold UK real estate through an offshore company which may in turn have been held by offshore trustees. Annual assessments are made by utilizing accepted professional real estate mass appraisal methods techniques and standards.

Writing A Property Tax Assessment Appeal Letter W Examples

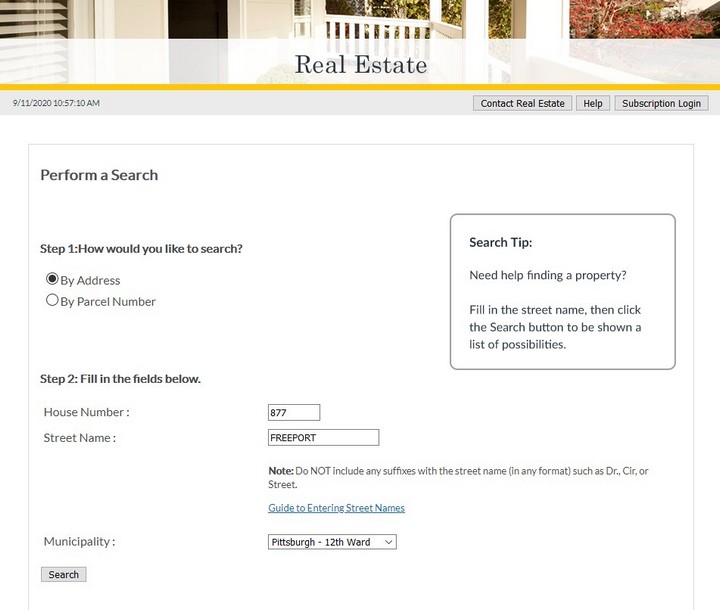

Find All The Assessment Information You Need Here.

. If you disagree with your property assessment. 1 day agoIf the property was used to generate rental income and youve owned it for a number of years you will pay capital gains tax on the profit from the sale. In general you should expect real estate taxes to be considerably higher when compared to personal property taxes.

Setting tax levies evaluating values and then collecting the tax. General Property Tax Information. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

In a nutshell capital gains tax is a tax levied on possessions and propertyincluding your homethat you sell for a profit. Mass appraisal is defined by the International Association. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

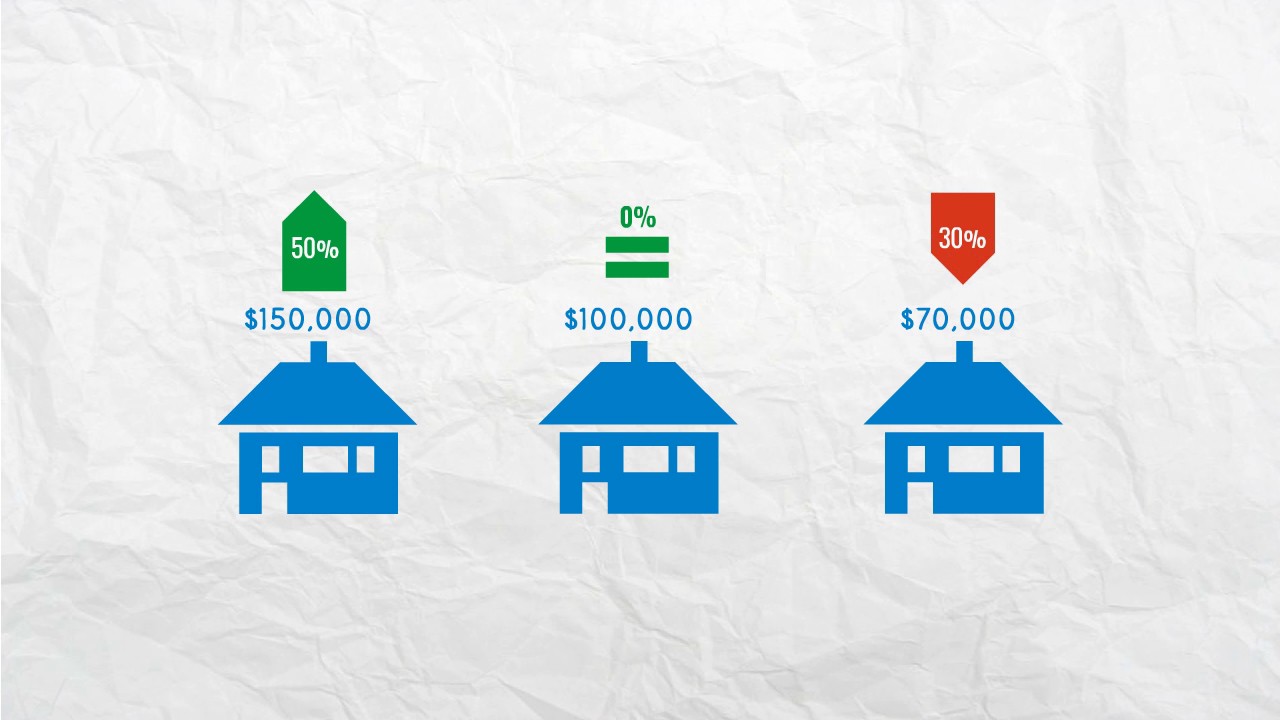

New Jerseys real property tax is an ad valorem tax or a tax according to value. All sales of real property in the state are subject to REET unless a specific exemption is claimed. All real property is assessed according to the same standard.

Code of Virginia 581-3330. The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA. Discover the Registered Owner Estimated Land Value Mortgage Information.

Property tax is an ad valorem tax assessed on real estate by a local government and paid by the property owner. The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. To ensure property descriptions are.

This means that you can deduct the amount of tax that you paid from your overall taxable income. If you sell it in one year or less you have a short-term. For instance an annual car registration for a vehicle thats valued at.

The capital gains inclusion. 189 of home value. Real estate taxes are deductible on your federal income tax return.

The Real Estate Assessments Office collects information regarding property descriptions property sales and other real estate market data. Property owners are provided with an annual official notice of the assessed value of their real property for local tax purposes. Real estate excise tax REET is a tax on the sale of real property.

Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family owned real. In general there are three aspects to real estate taxation. A special assessment tax is a surtax imposed on property owners to pay particular local infrastructure projects such as road building and maintenance.

The assessment is used to calculate the property tax which is paid by the owner of the property. The goal of commercial property assessments is to provide a comprehensive. Real Estate Assessment Notices.

DTA uses that data to annually assess. Lets look at the details. Tax amount varies by county.

Ad Unsure Of The Value Of Your Property. Taxing units include Weehawken county governments and various.

What Is A Property Tax Assessment Real Estate U S News

Understanding Your Real Estate Assessment Notice Youtube

114 Property Tax Assessment Illustrations Clip Art Istock

Understanding California S Property Taxes

How To Calculate Property Tax Bill City Of Paducah

Countywide Property Assessment Yeadon Borough

Understanding Property Assessments Property Taxes Youtube

Deducting Property Taxes H R Block

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Automated Home Valuation Avm And What It Can Do For Your Tax Assessment

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Writing A Property Tax Assessment Appeal Letter W Examples

The New Age In Indiana Property Tax Assessment

Delaware County Real Estate Lawyers Fighting Property Tax Assessment

It S Time To Rethink Tax Assessments For Real Estate Valuations Lenderclose

Free 9 Sample Property Assessment Templates In Pdf

/shutterstock_262923179-5bfc3a3f46e0fb00265fdad8.jpg)

:max_bytes(150000):strip_icc()/GettyImages-13484945191-47df439c13e74fcab1c078592813ac27.jpg)